About Us

“Market insouciance is palpable; examples of speculation, new and old, pop up almost daily. In many instances, the fundamental tenets of rational, margin-of-safety investing – discounted valuation, aligned managements, sound business quality – have been replaced by desperation, short-termism and bravado.

While these are my impressions, I assiduously try to avoid predictions about markets and instead focus on what I can control, including, most importantly, OPF’s investment process. I take my cues from what managements have done – their “footprints in the sand” – and what the numbers mean from a long-term perspective, rather than what they are at a given moment. Lastly, I believe the Fund’s long-term investment time horizon has conferred it an ever greater advantage over and distinguishes it from those investors who appear to be playing an entirely different and more perilous sort of game…”

– Curtis Jensen

In his 1Q21 commentary, Portfolio Manager Curtis Jensen:

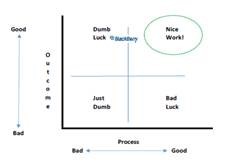

-Luck v. Skill in investing – From Bruce Springsteen podcasts to Poker star Annie Duke, Curtis discusses views on stock selection and performance through this well-discussed lens and explains the below table.

-The Search for Rational Investments: Curtis shares his theses on two newly initiated holdings that filtered through his Owner-Operator based Idea Funnel – and lessons from a recently exited position

Please email us at ir@robotti.com for the full letter and additional insights.